A Weird Way To Value Collectible Watches, and Collecting the Patek Philippe 3970

Tell me I'm crazy.

Last night, we had our first Founding Member Meeting with Adam from Menta Watches. The Q&A centered on always-hot topics like service, restoration, and laser welding, which reminded me these are evergreen issues the newsletter should also cover in fun and fresh ways.

In today’s free newsletter:

A Collector’s Guide to the Patek Philippe 3970, and why it’s finally getting the attention it deserves.

A weird new idea for valuing collectible watches.

A closer look at a $500 GMT with pretty perfect dimensions.

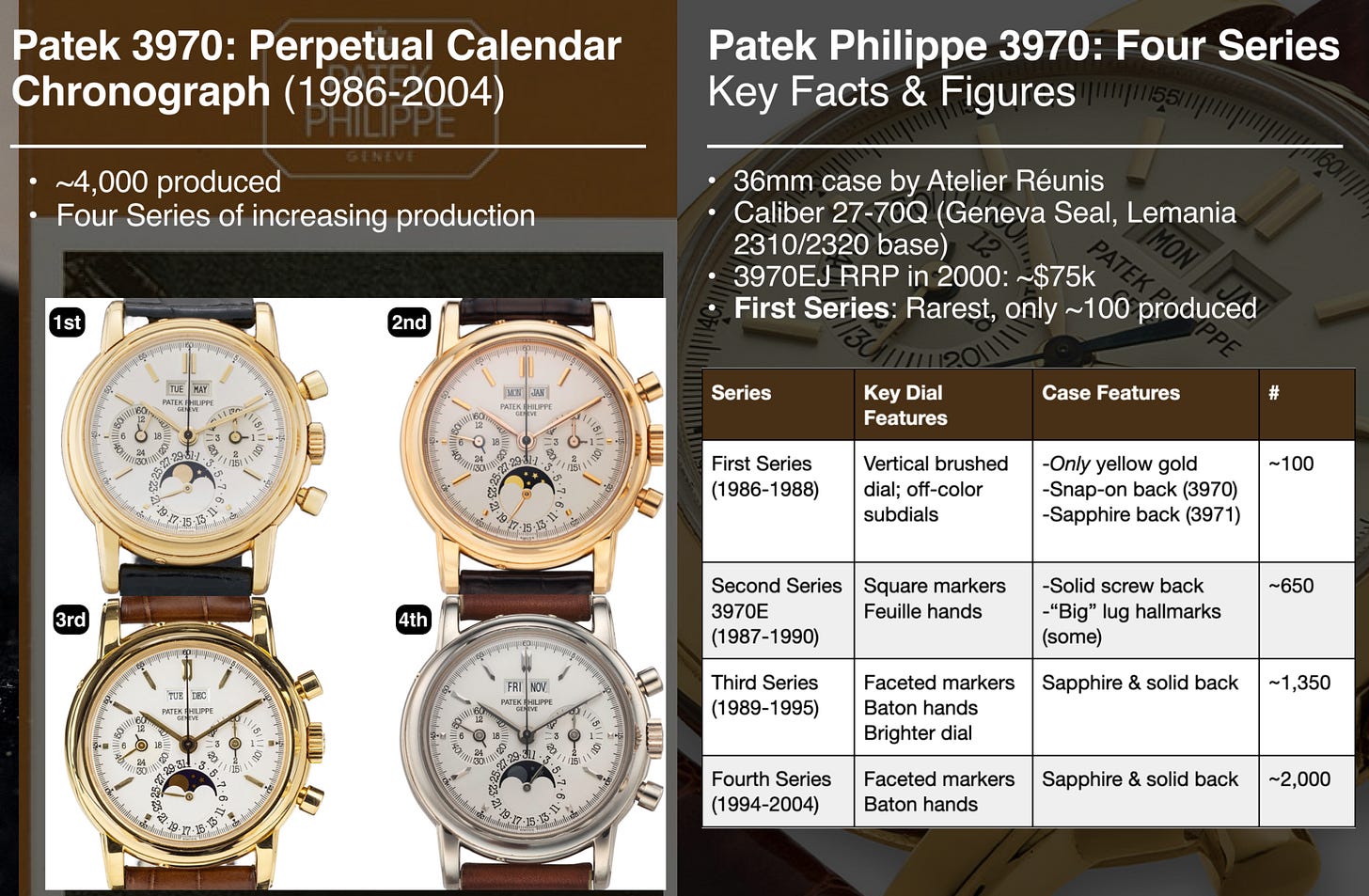

Everything you need to know about the Patek Philippe 3970 Perpetual Calendar Chronograph

If you were a watch collector in 2000, on the hunt for the ultimate vintage Patek Philippe, you might’ve ended up with a ref. 2499 Perpetual Calendar Chronograph—about 40 years old at the time, there would’ve been no denying it as a real, vintage Patek.

Today, someone might come to the ref. 3970 with the same POV. Introduced in 1986 after the 2499, the 3970 will celebrate its 40th anniversary in 2026.

This is the setup of the Collector’s Guide to the 3970 Perpetual Calendar Chronograph I wrote with Collectability. It’s perhaps my favorite “Collector’s Guide,” organizing a ton of info and new research on the 3970.

Produced from 1986–2004, the 3970 is Patek’s bridge from vintage to modern. With age, collectors are starting to treat the 3970 more like a vintage Patek—in prices, scholarship, and evaluation condition.

In addition to John Reardon of Collectability, I spoke to a few other collectors for the article. But it’s always funny to hear from people after publishing something like this, everyone with their own insights, perspectives, or opinions—I continue to learn about the 3970. All that to say: Get in touch if you wanna chat 3970.

👉 Collector’s Guide: Patek Philippe 3970 Perpetual Calendar Chrono

So You Wanna Buy A Patek Philippe 3970?

Part of the why now for this 3970 Collector’s Guide is that the market has changed a ton in the past couple of years. The First Series has seen the biggest bump, with collectors catching on to the fact there are only ~100. Since their defining feature is a snap-on caseback, there’s also a good chance significantly fewer have survived in decent condition (only about 20 are known to the market).

First Series. The Collector’s Guide briefly discusses the market. Here’s a snapshot of what it looks like right now:

Most notably, a First Series sold for $416,000 at Phillips in November.

Surprisingly, Tom Brady’s First Series—the second 3970 ever made, no less—sold for “only” $312,000 last December. That buyer got himself a deal.

Meanwhile, a private European dealer is currently asking $365k for a First Series 3970.

Second Series. The Second Series isn’t far behind, especially in metals other than yellow gold. For example:

Hairspring sold a Second Series 3970P for $400k last weekend (only 11 Second Series are known in platinum).

Collectability is asking $240k for a Second Series 3970R (estimated 60 in pink gold).

Another private dealer had a Second Series in yellow gold for $200k.

These prices would’ve felt insane just a year ago. Part of this is the natural arc of collecting. As a watch ages, research develops and the early examples in particular shoot up in price.

Later series haven’t quite seen the same increases. Beyond just rarity, some changes to the Third and Fourth Series make them less charming:

The hands switch from feuille to batons

The dial is a brighter white

Collector’s tip: That said, I agree with John’s tip that “I’d rather have a mint third series with box and papers than an over-polished earlier series.” Right now, collectors really want early 3970s. But there’s not as much price distinction between a mint, full-set later series and a “beater” 3970.

One email I received the other day went something like this: “I just put down a deposit on a Third Series full set 3970J (yellow gold) in mint condition for $120k. I may be overpaying, but it’s not easy to find that quality and full set. What do you think?”

It’s the classic adage: For a good watch, sometimes you have to be willing to pay tomorrow’s price today.

A Weird Idea For Valuing Collectible Watches

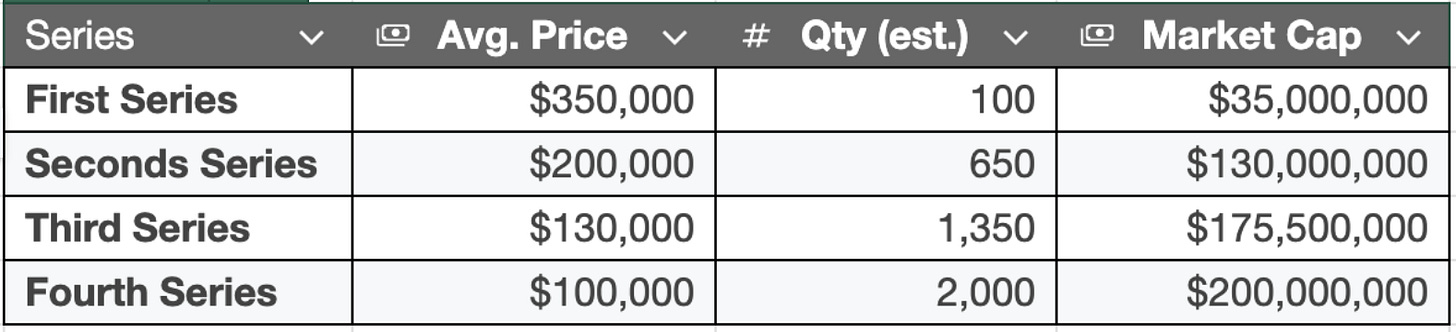

I have no idea where 3970 prices are going, but I wanted to try something inspired by a Doug DeMuro take on valuing exotic cars.

What if we borrow the financial concept of market capitalization to better quantify how the market truly values a watch? To find a watch's total market value, take:

Total watches made x Avg. market price = Total market value

This gives us a number that’s more meaningful than price alone. If you break down the 3970 into its Four Series and make some assumptions, here’s what you get:

I wasn’t sure if this was a useful exercise, but then I thought of some 80s-90s watches I could compare to the 3970. The first two I came up with were the Cartier Paris Crash 1991, a limited edition of 400, and the First Series Patek ref. 3940 Perpetual Calendar, estimated production around 1,000.

Total market value for each:

1991 Cartier Crash: 400 made x $200,000 = $80 million

First Series 3940: 1,000 made x $80,000 = $80 million

Interesting!

And remember that Monaco Legend recently listed a steel Patek Philippe 1518 for $20m. There are 4 steel 1518s, which gives us: another $80 million total market value!

I’m not necessarily saying that a watch with a higher or lower market cap is over- or undervalued, but it provides a useful relative comparison for how the market views what are otherwise very different watches.

I’m also not about to argue that a First Series 3970 should be $800k—the price that would put its total market value on par with the Crash or First Series 3940—BUT:

Before this little thought experiment, I assumed the First Series market had gotten too frothy. But when you put it in perspective, a First Series 3970 can start to feel…undervalued? Or maybe the Crash and 3940 are overvalued?

There are at least a few potential critiques of this method:

Rolex has made millions of Datejusts over the past decade, so isn’t the most valuable watch by market cap the modern Datejust? This only works with limited-production, collectible watches, okay?!

At what level does it make sense to compare total market values? For example, should we be looking at all 3970s? Just First Series? Here, I think it’s whatever distinction is meaningful to collectors, e.g., a collector doesn’t ask for any 3970, they want a First Series.

Market cap should be calculated on watches available today, not original production numbers. I don’t disagree, but this is also difficult to know.

Don’t apply financial calculations to watches, they’re not investments! Yes, yes I know—it’s not investment advice. But also, we’re talking bout six-figure toys, so I’m merely offering this as another lens through which you can think about prices.

Let me know what you think of this market cap idea. I think it’d be fun to explore in a full newsletter—wouldn’t it be interesting to compare, e.g., the Patek 1518, Dufour Simplicity, and the Rexhepi Chronometre Contemporain on a standardized metric?

A $500 GMT with Perfect Dimensions

Nodus Watches just released their Sector II GMT. It caught my eye because it’s a caller GMT measuring 38 x 11.9mm for $525. Not bad.

Beyond just its watches, Nodus is fascinating because it’s open and transparent about producing watches in China.

I talked to Wes Kwok of Nodus who explained that they accomplished this thinness by producing a box-shaped crystal with a large enough cavity that allows the dial and hands to sit closer to the glass. This and the 24-hour sloped rehaut cleverly “hides” much of the Seiko movement’s thickness.

Comparing the Sector II GMT to my Black Bay 58, it’s easy to see how much closer the hands and dial are to the crystal. A smart solution to the thickness problem plaguing so many modern watches.

Nodus has a close relationship with its suppliers, allowing it to make these improvements while keeping costs low. As things get thinner, tolerances are smaller—for example, if the hands are just a micron too long, they might start to drag on the dial—but Wes said that Nodus’ strong relationship with suppliers means they don’t absorb the increased rejection rate that comes with lower tolerances.

Head to Nodus for more on the Sector II GMT.

I’m fascinated by crystals and previously talked to Wes for this in-depth article about crystals on Hodinkee. For those interested in watch production in Asia, also check out Wes on Collective Horology’s podcast:

More on Breitling x Gallet

Time and Tide had me on to chat about Breitling’s acquisition of Gallet. Honestly, I’m surprised there wasn’t more chatter about the Gallet news. It’s a reminder that Gallet’s no Universal Geneve–not even close. It’s a niche brand for vintage collectors (mostly American), with most of its 40s-60s chronographs somewhere between $4-7k. And man, there are some badly restored Gallet watches all over Chrono24 and eBay.

The Roundup

📓 Timex x New Yorker Marlin: A cool limited edition to celebrate the New Yorker’s 100th anniversary.

🤐 “I have lost all faith in zippers.” As someone who recently took a snagged zipper jacket to the Patagonia store and was told it’d be an 8-week wait to fix (!), this one hit home.

That’s all for today’s free newsletter. The paid newsletter will come on Saturday this week, so make sure you’re subscribed if you want it in your inbox.

Get in contact:

Email: tony@unpolishedwatches.com

Or like and comment on this post:

I don't think you are nuts Tony. Thinking about values and the watch market is an interesting and sometimes useful exercise. Most of us will never own any of the stratospheric icons of the watch world for which you can apply your metrics but your numbers are interesting. Most of us would love to be able to value into the future our mundane goods like the vintage Heuer/Zenith/JLC/Breitling/UG/Omega etc but most of us know that an average vintage watch is simply worth what someone is willing to pay on a given day. During the pandemic, I got a call one day from a lawyer here in town who said he was representing a group of lawyers who wanted to "invest" in watches, mostly Patek and Rolex. He said that someone had told him I knew how to buy watches. I told him that I was not interested and that when I bought Patek and Rolex watches my aim was to buy them and sell them within a few days and that I already had plenty of paying customers. He asked me if there was money in these watches as a longer term investment and I said "no, not in my opinion." I never spoke to him again and...as it turned out, I was wrong, at least in the short part of the long term. Rolex and Patek went way up. That said, I still know a lot of people, from guys like this lawyer to fairly knowledgeable watch dealers who are stuck with, inventory, especially Rolex, that they paid way over list for and were not willing to take their losses and move on. For me, watches as an investment is only a good thing if they are gone and paid for in a few days...but then people say I am nuts and they are probably right.

🔥